NMLS Consumer Access: Your Guide to Transparent Licensing Information

Introduction

Contents

- 1 Introduction

- 2 The Importance of NMLS Consumer Access

- 3 Benefits of Using NMLS Consumer Access

- 4 Who Can Benefit from NMLS Consumer Access?

- 5 NMLS Consumer Access and Regulatory Oversight

- 6 Case Studies: NMLS Consumer Access in Action

- 7 Enhancing Financial Literacy

- 8 Future Developments for NMLS Consumer Access

- 9 Conclusion

In today’s complex financial landscape, NMLS Consumer Access transparency and accessibility are more critical than ever. It is a powerful tool designed to give the public easy access to information about state-licensed companies, branches, and individuals involved in the financial services industry. This fully searchable website allows users to view licensing details and ensure that the entities they deal with are registered and in good standing. This article will explore its features, benefits, and importance, helping you understand how it can be a valuable resource in your financial decision-making.

What is it?

It is a free, fully searchable website that allows consumers to obtain information about financial service providers, including mortgage lenders, brokers, loan officers, and other state-licensed entities. This platform is part of the Nationwide Multistate Licensing System (NMLS), which was created to improve the oversight and transparency of the financial services industry. Offering a centralized location for accessing licensing information empowers consumers to make informed decisions when choosing a financial service provider.

The Birth of NMLS Consumer Access

The Nationwide Multistate Licensing System (NMLS) was established in 2008 to streamline and standardize the licensing process for mortgage professionals across the United States. NMLS Consumer Access was a natural extension of this initiative, aiming to provide the public with easy access to detailed licensing information. Making this data publicly available promotes transparency and consumer protection in the financial services industry.

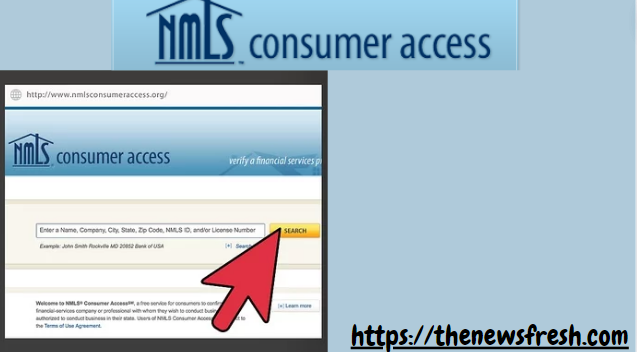

How Does NMLS Consumer Access Work?

It is designed with the public in mind, making it user-friendly and straightforward. To use the website, users enter the name or NMLS ID of the company, branch, or individual they wish to research. The system then provides detailed information about their licensing status, including the types of licenses held, their issuance and expiration dates, and any disciplinary actions or regulatory decisions. This data is updated regularly to ensure accuracy, giving users confidence in the information they find on NMLS Consumer Access.

Features of NMLS Consumer Access

It offers several key features that make it an invaluable resource for consumers:

- Search Functionality: The platform allows users to search by name, NMLS ID, or location, making it easy to find the information they need.

- Detailed Licensing Information: Users can view comprehensive details about the licenses held by financial service providers, including issuance and expiration dates.

- Disciplinary Actions: The website provides information about any disciplinary actions or regulatory decisions involving the entities listed, helping consumers assess their reliability and compliance with industry standards.

- Regular Updates: The data on NMLS Consumer Access is updated regularly to remain accurate and current.

The Importance of NMLS Consumer Access

The primary purpose of NMLS Consumer Access is to promote transparency and consumer protection in the financial services industry. By making licensing information readily available, it helps consumers verify the legitimacy of the entities they are dealing with, reducing the risk of fraud and misconduct. Whether seeking a mortgage lender, a financial advisor, or another licensed professional, it ensures you have the information you need to make sound decisions.

Benefits of Using NMLS Consumer Access

Using NMLS Consumer Access comes with several benefits:

- Transparency: it provides detailed, up-to-date information about licensed entities, giving consumers a clear view of their credentials and regulatory history.

- Consumer Protection: By verifying the licensing status of financial service providers, users can avoid dealing with unlicensed or unethical individuals or companies.

- Ease of Use: The website is designed to be intuitive and easy to navigate, allowing users to find the information they need quickly.

- Comprehensive Data: it covers a wide range of financial services, making it a one-stop resource for consumers looking to verify the legitimacy of various entities.

Who Can Benefit from NMLS Consumer Access?

It is a valuable resource for a wide range of users, including:

- Consumers: Individuals looking to engage with financial service providers can use NMLS Consumer Access to verify companies’ and professionals’ licensing status and history.

- Regulators: State and federal regulators can use NMLS Consumer Access to monitor the activities of licensed entities and ensure compliance with industry standards.

- Industry Professionals: Financial service providers can use it to confirm the licensing status of potential partners or competitors.

NMLS Consumer Access and Regulatory Oversight

It plays a critical role in regulatory oversight by making licensing information public. This transparency ensures financial service providers adhere to state and federal regulations, helping maintain the industry’s integrity. NMLS Consumer Access supports the broader goal of enhancing consumer confidence in the financial system by providing a platform where consumers can easily access this information.

Case Studies: NMLS Consumer Access in Action

To illustrate the practical benefits of NMLS Consumer Access, let’s look at a few hypothetical case studies:

- Case Study 1: Homebuyer Verification: A prospective homebuyer is looking for a mortgage lender and comes across several options. By using NMLS Consumer Access, they can verify the licensing status of these lenders, ensuring they choose a reputable and licensed provider.

- Case Study 2: Regulatory Compliance Check: A state regulator uses NMLS Consumer Access to monitor the activities of a licensed mortgage broker suspected of non-compliance. The detailed information helps the regulator take appropriate action based on verified data.

- Case Study 3: Industry Partnership: A financial advisor looking to partner with a loan officer uses it to verify the loan officer’s credentials, ensuring they are licensed and in good standing.

Enhancing Financial Literacy

NMLS Consumer Access also enhances financial literacy among consumers. The platform encourages consumers to research and verify financial service providers actively by providing easy access to licensing information. This empowerment leads to more informed decision-making and confidence in navigating the economic landscape.

Future Developments for NMLS Consumer Access

As technology and the financial services industry evolve, so will NMLS Consumer Access. Future developments include enhanced search capabilities, more detailed licensing data, and integration with other financial oversight tools. These advancements will further strengthen the platform’s ability to promote transparency and protect consumers.

Conclusion

In a world where financial transactions and decisions are becoming increasingly complex, NMLS Consumer Access is a beacon of transparency and consumer protection. This fully searchable website lets users view detailed information about state-licensed companies, branches, and individuals, helping them make informed decisions and avoid potential risks. Whether you’re a consumer, regulator, or industry professional, NMLS Consumer Access is an indispensable tool that ensures access to the information you need. By utilizing it, you are taking an important step toward safeguarding your financial future.

Leave a Reply